Credit Facility ManagementManage Your Credit Facilities with Confidence and Efficiency

Dynamic Reporting and Modeling

Streamlined Operations

Transparency and Reliability

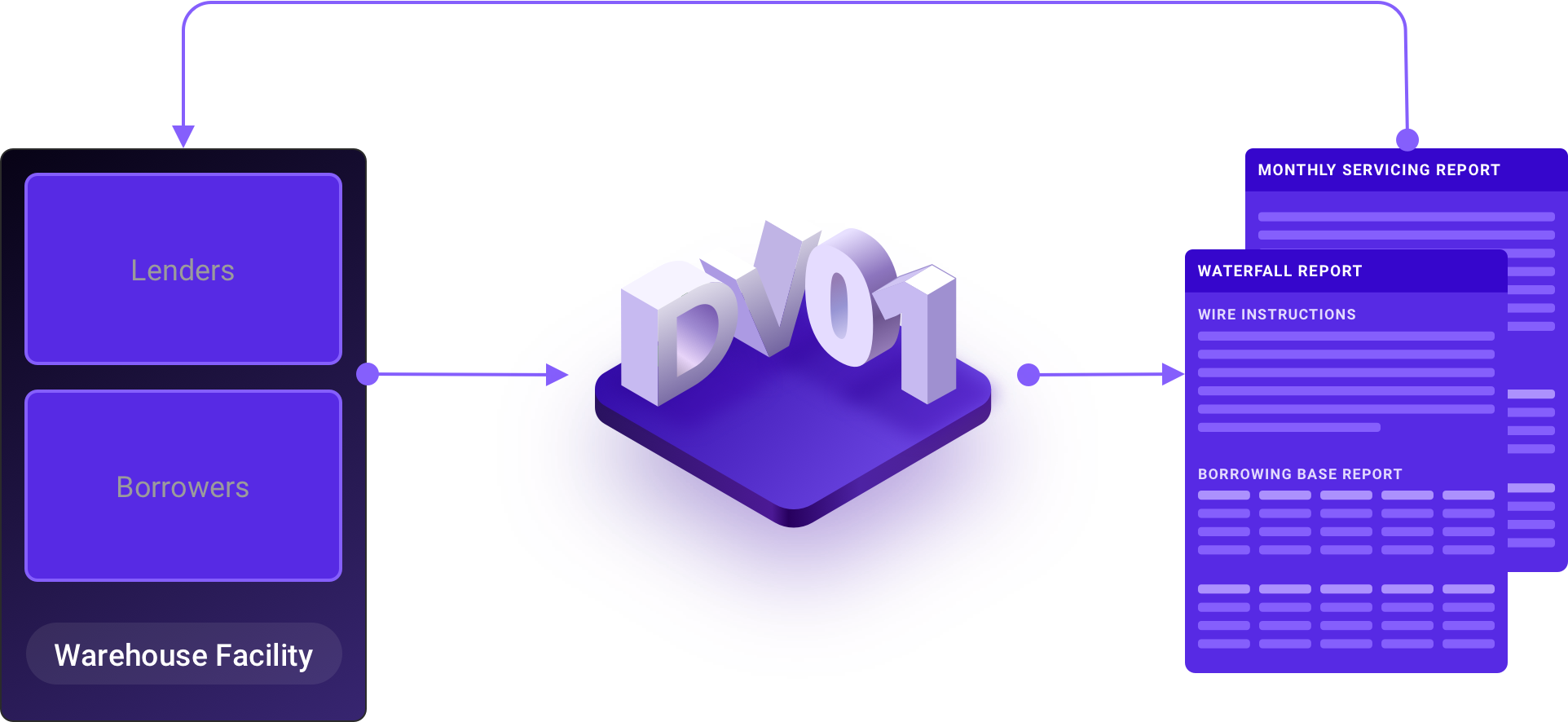

Institutional warehouse lending is complex. Reporting with dv01 isn’t

Streamline credit facility reporting for peak operational efficiency and improved credit risk mitigation. Configure performance-related triggers, set concentration limits, and gain insights into the size of any breaches—all with loan-level data.

dv01’s fully customizable solution can meet the requirement of any lending facility, regardless of asset class.

Calculation Agent

Whether it’s borrowing base reports, validation reports, waterfall reporting, or ad-hoc reports, dv01 ultimately provides an accurate picture of the collateral’s value as well as a drill down on how valuation is derived. As more facilities transition out of mark-to-market, dv01 acts as a single source of truth by validating data and confirming calculations across multiple stakeholders.

Verification Agent

dv01 certifies the veracity of borrower reports and confirms that pledged loans correspond to real consumers. dv01’s automated process delivers results in minutes, granting loan issuers access to capital faster and warehouse lenders confidence in the reporting.

Maximize liquidity and streamline credit facility management through smart loan allocation

Managing credit facilities involves navigating complex credit agreements, diverse loan portfolios, and shifting market conditions. dv01 transforms this intricate process by translating credit agreements into actionable mathematical frameworks. By plugging in loan-level data, dv01 delivers precise recommendations for optimal advance amounts for your warehouses.

With dv01’s solution, borrowers can streamline loan pledging, optimize collateral utilization, and unlock enhanced liquidity—empowering them to capitalize on market opportunities and maintain financial agility.

Daily Assignment

Loans are assigned on a daily basis across your facilities, ensuring constant optimization

Diagnostic Reporting

Receive a comprehensive report outlining the optimal distribution of loans across your facilities

Scenario Modeling

Explore various scenarios for optimal leverage within your facilities, such as amendments, loan sales, and securitizations to make informed strategic decisions