Tape CrackerCrack and Analyze Loan Tapes in Record Time

Accelerate Data Prep Workflow

Achieve Data Reliability

Enhance Bidding Strategy

Automate tedious tasks for a faster data preparation workflow

Transform dirty data into trusted data and improve productivity by leveraging state-of-the-art technology

Machine Learning Data Mapping

Fields are automatically mapped in accordance to your data dictionary and patterns are recognized to suggest matches for new fields.

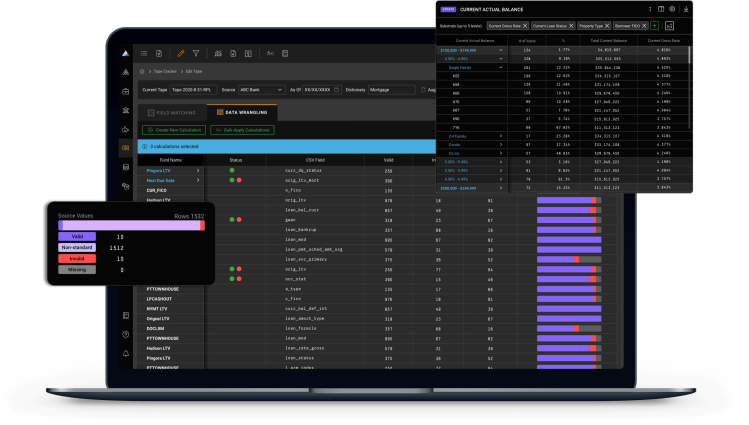

Faster Data Correction and Transformation

Bad data and missing values are quickly identified to help you resolve errors in seconds.

Built-in tools for quick insights

Extract insights about loan quality and tape composition through built-in tools.

Reporting Tools

Visualize data by any loan field to drill into the specifics and identify patterns easily through pivot, strat, and summary tables.

Built-In Cashflow Engine

Determine loan performance assumptions, including prepayments, delinquencies, and defaults, to forecast cashflow under multiple scenarios.

Loan Filtering

Determine loan performance assumptions, including prepayments, delinquencies, and defaults, to forecast cashflow under multiple scenarios.

Calculation Library

Manipulate your data with functions and formulas by creating calculations. Bulk apply calculations across your tape to save yourself some time.

A modern workflow for increased efficiency

Upgrade your experience working with team members and external partners with collaboration features.

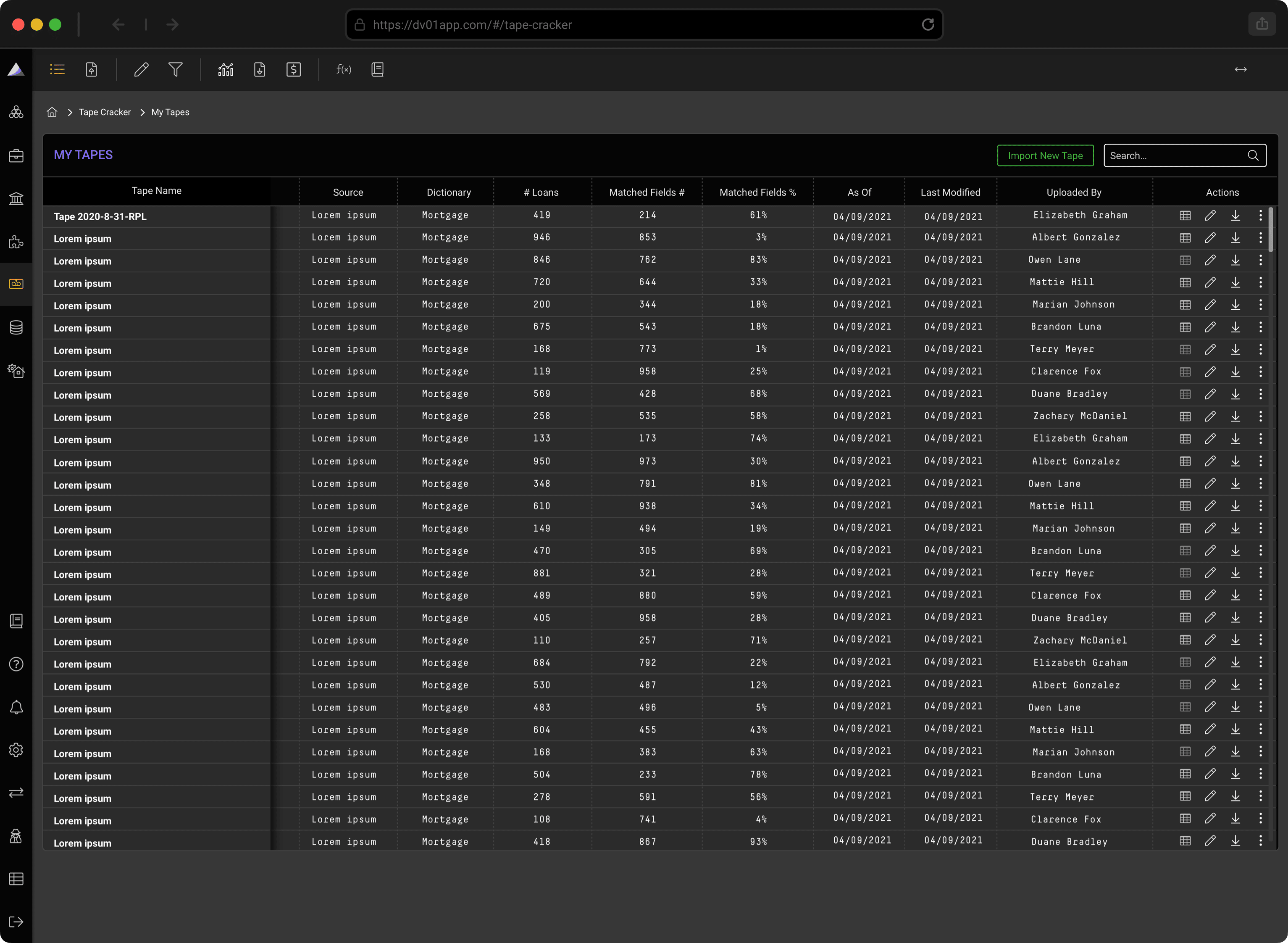

Collaborative workspace

All tapes, calculations, and reports belong to the team instead of one user, so your team always has access to the files and tools to get work done.

Audit Trail

Keep track of the changes made to your tape and by whom by downloading an audit trail of actions performed.

External Report Sharing

Replace risky email attachments by sharing bid tapes and reports with secure links. Don’t worry, you can revoke access with a click.

Enrich data for elevated insights

Derive deeper insights by merging new data points that level up your bidding strategy.

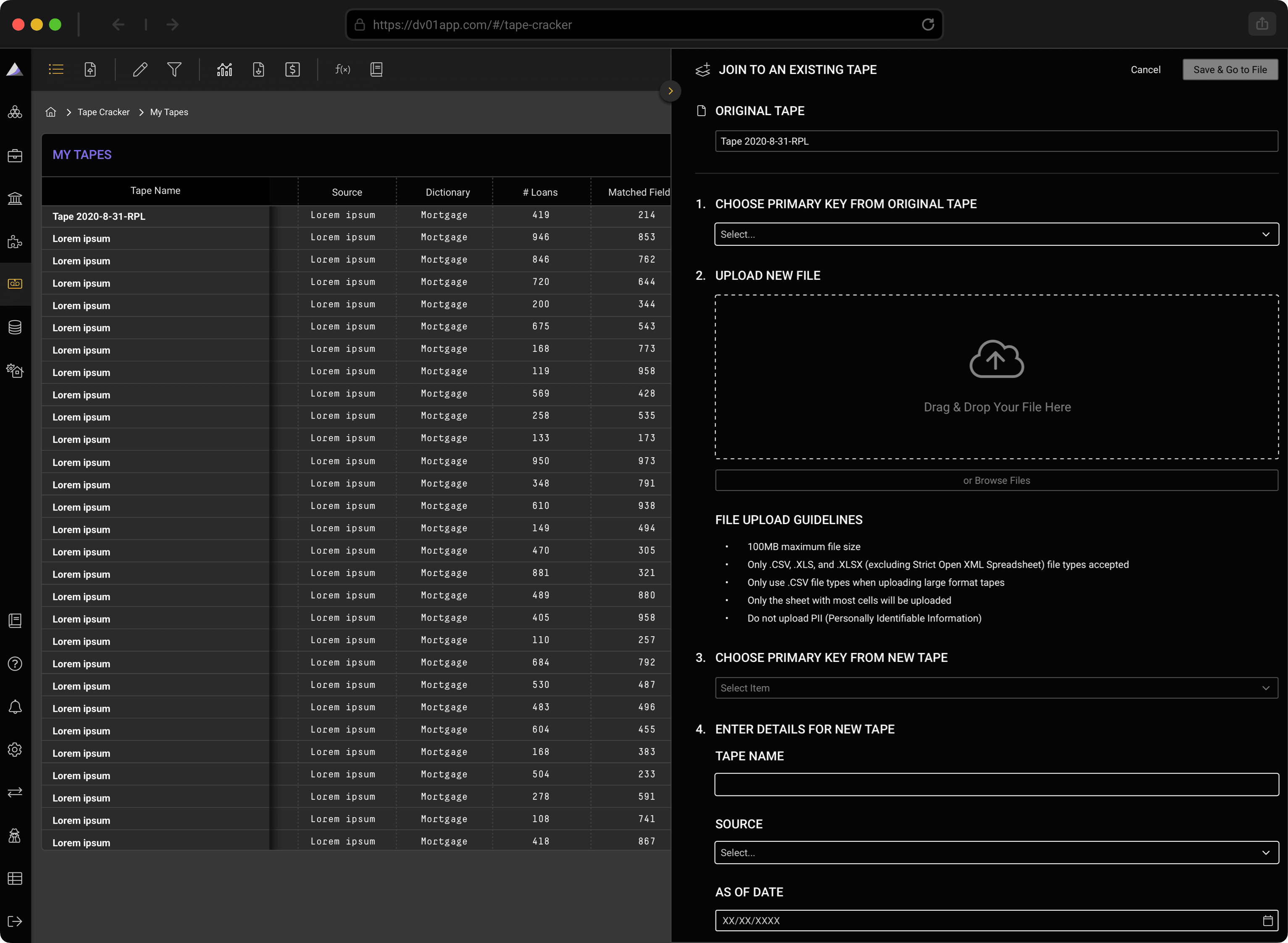

Join Multiple Loan Tapes

Seamlessly refresh data points and incorporate new data records by combining files as you progress in the due diligence process and receive updated loan tapes.