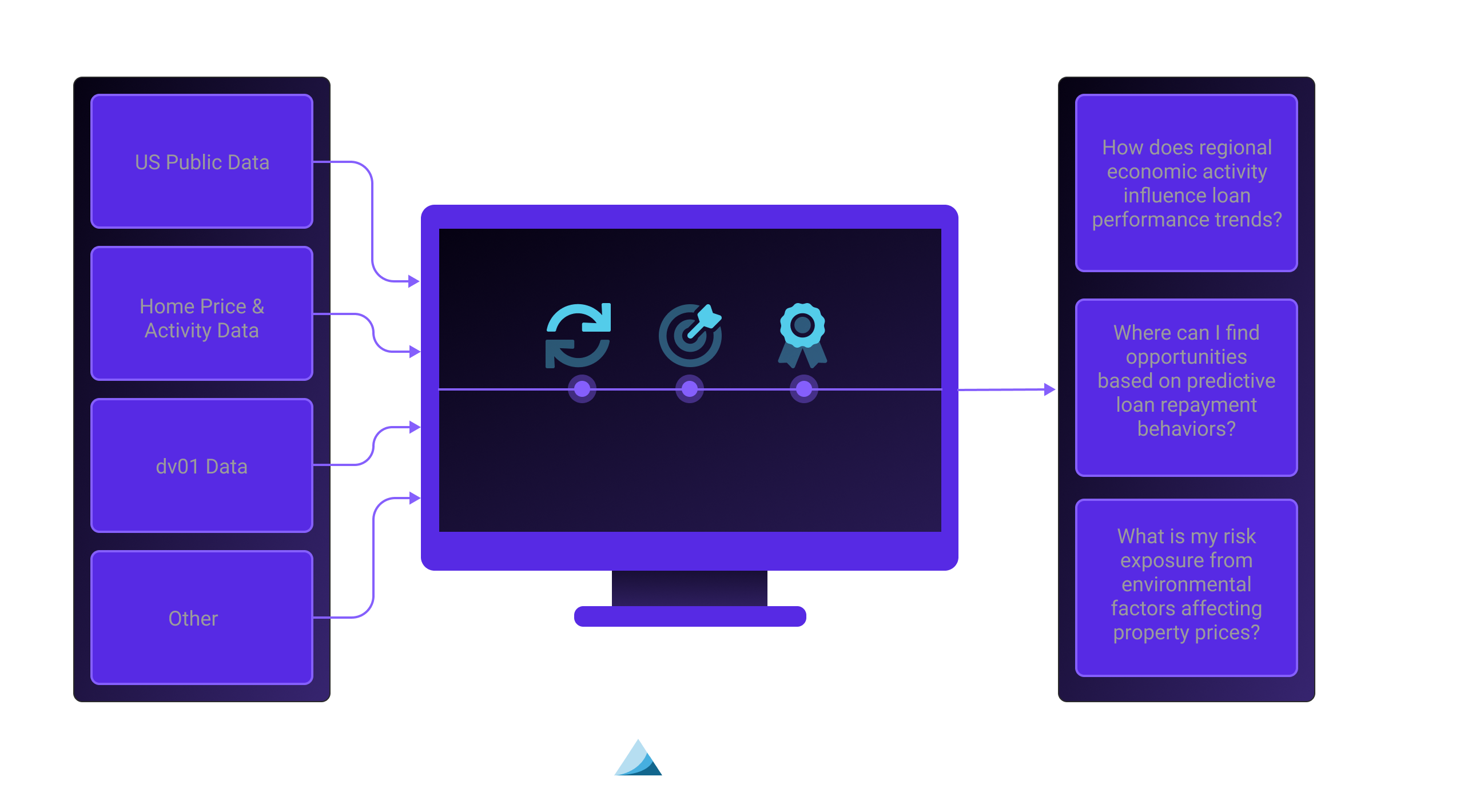

Enhanced Data and InsightsUnlock Alpha-Generating Insights with Third-Party Data

Elevated Competitive Advantage

Improved Risk Assessment

Seamless Data Integration

Unlock new dimensions of data to drive better decision-making

dv01 transforms disparate information into analysis-ready data observable at the loan level.

Our third-party data is sourced from reputable organizations, including FEMA, the U.S. Census Bureau, the Bureau of Labor Statistics, Zillow, Redfin, and more.

Seamlessly enhance your loan data with detailed insights

Unlike standard data providers, dv01 offers more granular data—at ZIP Code or county level—that is standardized and validated, and can be seamlessly integrated into loan-level data.

Affordability Ratios

dv01 calculates affordability ratios, incorporating inclusive costs such as insurance and property taxes, to reveal true affordability. These ratios are then appended to individual loans, providing a comprehensive view of borrower capacity.

ZIP Code Rankings by Performance

Our proprietary ZIP code ranking algorithm predicts expected credit behavior and provides unique insights. Regression testing indicates a strong positive correlation between our ZIP code rankings and near-term credit performance.

ESG Variables

Gain insights into the loans and security balances that adhere to five market-accepted ESG standards. Over 40 ESG data points relevant to responsible investing can be appended to loans, allowing for detailed analysis of credit performance and exposure.