Non-QM Prepayment ModelTame the complexities of prepayment forecasting in Non-QM.

Accurately Forecast Prepayment Trends

Identify Contributing Performance Factors

Manage Risk Effectively

Crack open the black box in Non-QM prepayments

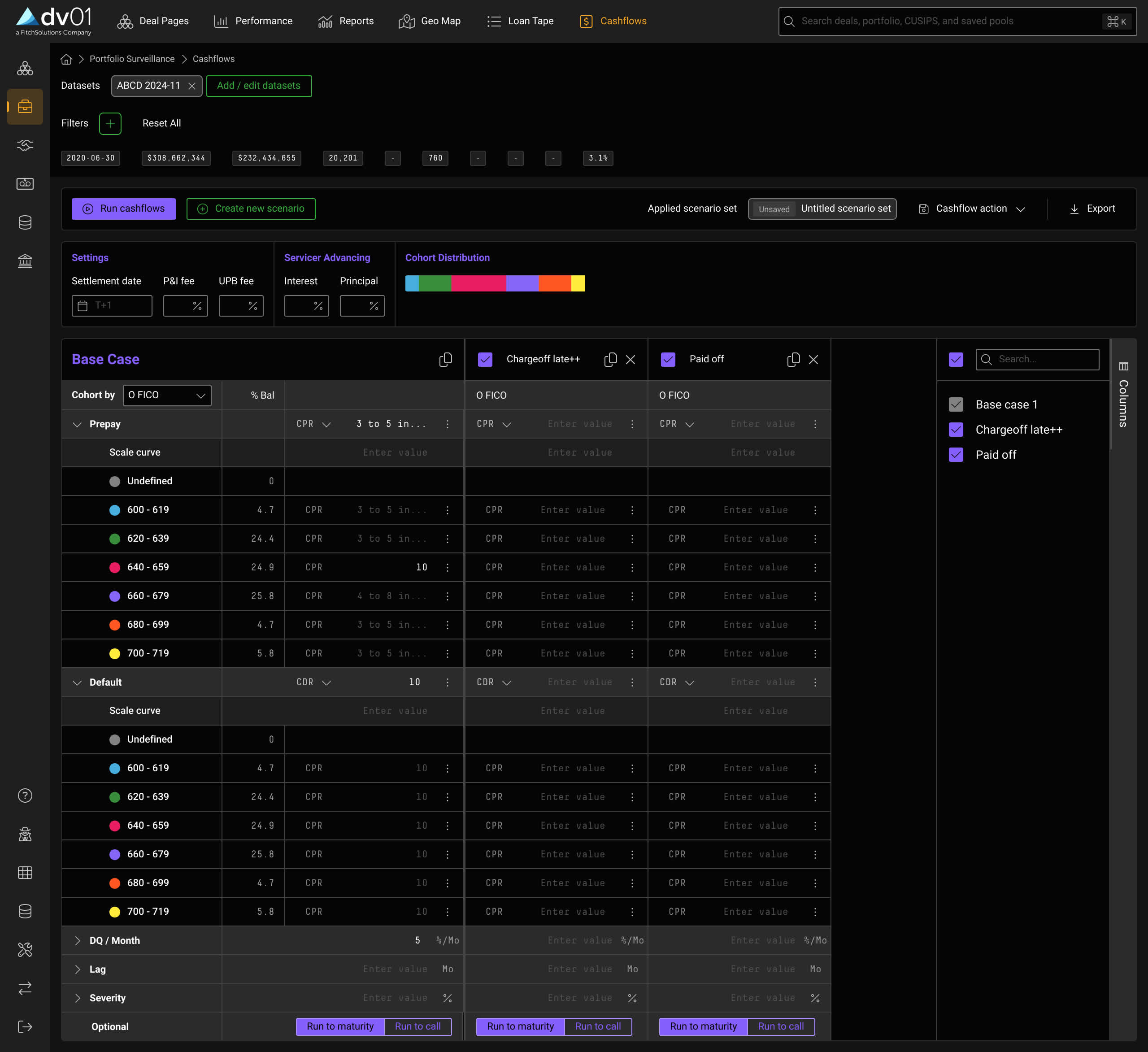

Investors of residential mortgage-backed securities require tools that capture the nuances of the non-qualified mortgage sector.

dv01 offers an innovative prepayment model built to navigate macroeconomic conditions, volatility, and the rapid rate moves in the non-QM market. Dive into the dv01 Non-QM Prepayment Model through our technical white paper here.

Extract actionable performance insight

Standardized loan-level data fuels the dv01 Non-QM Prepayment Model, sharpening your comprehension of key performance drivers.

Leverage Rate Incentive

Unlike agency loans, there is no standard market rate for Non-QM loans. Through rich data-driven research, the dv01 Non-QM Prepayment Model leverages the most suitable reference rate to gauge the likelihood of borrowers refinancing across ARM and fixed-rate mortgages.

Incorporate Non-QM Variables

Unlike other models, the dv01 Non-QM Prepayment Model is built with unique variables in the sector, such as doc type, occupancy status, and amortization type.

Dive Into Key Performance Drivers

Determine how your portfolio performed against the broader market through a performance attribution report. dv01 can use its Non-QM Prepayment Model to isolate the impact of specific variables and their contribution to prepayment differences between a specific bond and the dv01 Non-QM Benchmark.

Forecast Prepays Over 12 Months

Anticipate duration risk given the extension uncertainty. dv01 updates its prepayment model frequently, incorporating the latest data to reflect key changes in the Non-QM market.