Press

dv01 Expands Mission of Providing Lending Market Transparency with Launch of Auto Benchmark Datasets

25 January 2021

Datasets consist of benchmarks for both prime and subprime auto ABS

Data library covers $294 billion in original balance value

Announcement follows successful Series B3 funding round and acquisition of Pragmic Technologies

NEW YORK – 01/25/2020 – dv01, the leading capital markets fintech driving technological innovation and loan-level transparency in structured finance, today announced that it has launched its Auto Benchmark Datasets to provide investors with cutting-edge, loan-level performance transparency on automotive asset-backed securities.

The new benchmarks pull Reg AB data from EDGAR to create both a Prime dataset—consisting of 133 transactions valued at $232 billion in original balance—and a Subprime dataset, consisting of 45 transactions valued at $62 billion in original balance. The data library at launch represents roughly 53% of all auto loan issuance since 2017, and going forward, dv01 will onboard all new deals to the platform at the point of issuance in real-time.

Auto ABS is a growing area of interest for institutional investors, but irregular and fragmented reporting between issuers causes obstacles for efficiently comparing deals and their underlying characteristics. With the Auto Benchmark Datasets, dv01 users will have access to a holistic view of the sector’s performance, as well as the ability to drill down into the performance of 180 specific deals and 11.7 million individual, underlying loans. The benchmarks, built entirely of cleansed, standardized, and normalized data from 22 auto issuers, will allow investors to more efficiently compare individual deals against a reference point, identify origination trends, slice data by loan characteristics, and analyze consumer behavior.

“Our recent acquisition of Pragmic Technologies set the stage for our growth this year,” said dv01 Founder and CEO Perry Rahbar. “The dv01 Auto Benchmark Datasets are simply the starting points for us in this market, and we are committed to bringing the same data transparency and value into this asset class as we already do for consumer unsecured, mortgages, small business, and student loans.”

The benchmarks are immediately available for users subscribed to dv01’s Market Surveillance offering, a comprehensive reporting toolkit that provides easy access to reliable consumer credit data and fully integrated analytics tools, and are included in the free trial.

MEDIA CONTACT

Peregrine Communications

Spencer Tait

dv01@peregrinecommunications.com / +1 202 420 9061

NOTES TO EDITORS

About dv01

Founded in 2014, dv01 is the leading capital markets fintech driving technological innovation and loan-level transparency in structured finance. To date, dv01 has provided securitizations reporting and analytics on $3.7 trillion in notional balance, consisting of 74 million loans and 620 securitizations across consumer unsecured, point of sale, small business, student loans, auto, and both agency and non-agency mortgages.

Receive the Latest Insights

Subscribe to our mailing list to stay up-to-date with the latest market insights and product updates.

Subscribe to NewsletterRELATED POSTS

Press

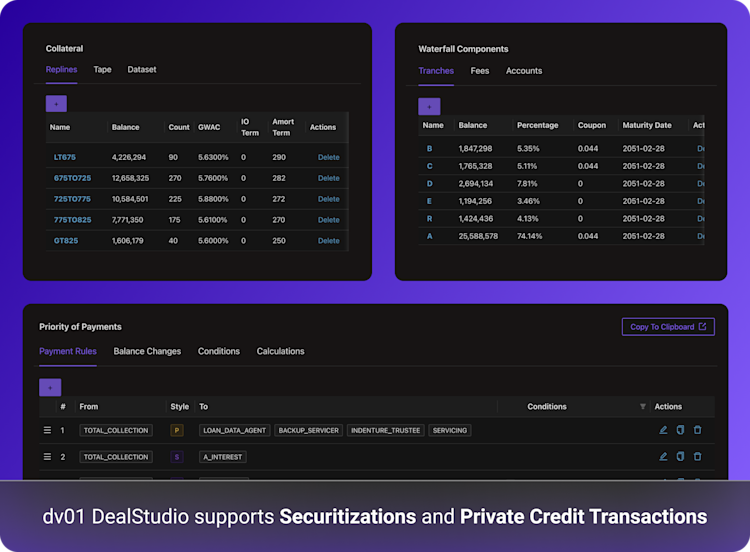

dv01 Unveils dv01 DealStudio: Structuring Tool to Streamline Deal Modeling for Private Credit Transactions and Securitizations

10 February 2025