Press

dv01 Unveils dv01 DealStudio: Structuring Tool to Streamline Deal Modeling for Private Credit Transactions and Securitizations

10 February 2025

dv01 Unveils dv01 DealStudio: Structuring Tool to Streamline Deal Modeling for Private Credit Transactions and Securitizations

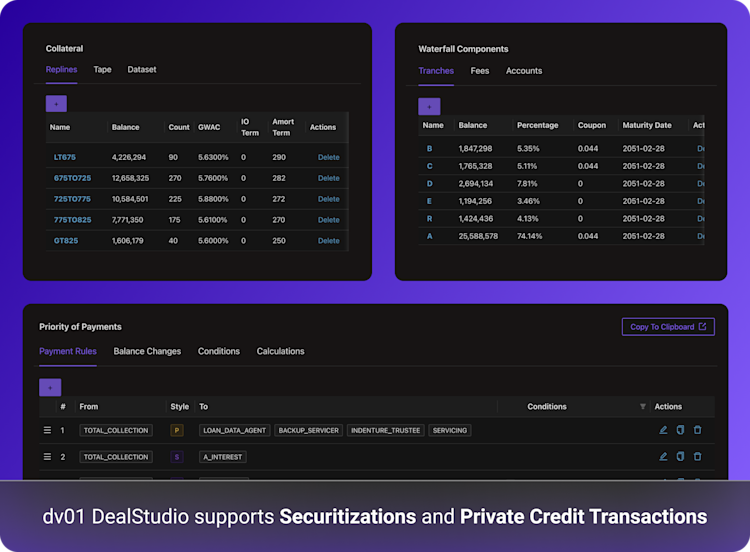

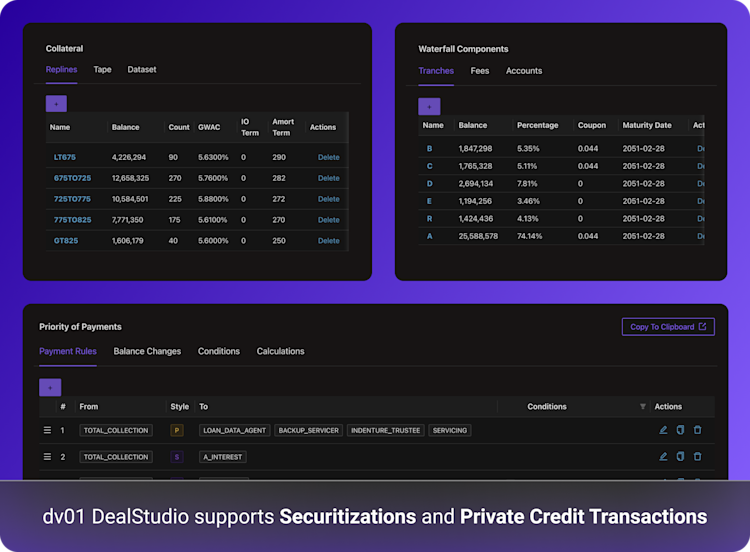

NEW YORK, Feb 10, 2025 — dv01, a leading provider of loan-level data management, reporting, and analytics solutions, announced the launch of dv01 DealStudio. Designed for private transactions and securitizations, dv01 DealStudio helps clients model, test, and execute deals with greater efficiency and confidence. With features like scenario modeling, tranche structuring, and waterfall analysis, dv01 DealStudio empowers users to streamline complex workflows and optimize deal outcomes.

“Deal structuring is a critical component of the issuer workflow, yet few accessible options truly address their needs,” said Perry Rahbar, Founder and CEO of dv01. “By integrating dv01 DealStudio into our platform, we are filling a gap and providing issuers a unified solution that simplifies workflows, eliminates inefficiencies, and enhances transparency. This development also strengthens dv01’s position as a premier partner for issuers, supporting them from loan origination to investor relations.”

Transforming Deal Structuring for the Modern Market

Evolving market dynamics, including the emergence of new asset classes and the expansion of private credit, are reshaping the financial landscape. Yet, issuers remain reliant on outdated software that has not evolved with user requirements—dv01 is changing that.

Integrated Tooling: dv01 DealStudio is seamlessly integrated into the dv01 platform, providing direct access to loan-level data standardized through Tape Cracker, dv01’s data wrangling tool.

User-Friendly Interface: Intuitive and easy-to-navigate design reduces learning curves and ensures quick and easy set up.

Attentive Client Support: A dedicated support team is available to assist with setup, provide guidance, and answer any questions and feedback you may have.

Robust Security: Compliant with SOC-2 certification standards, dv01 is regularly tested with third-party penetration testing to ensure data is secure and protected.

Transaction Support: dv01 DealStudio is designed to support RMBS and ABS securitizations and private deals.

Key Features

Developed for participants in Residential Mortgage-Backed Securities (“RMBS”), Asset-Backed Securities (“ABS”), and asset-backed private transactions, dv01 DealStudio’s features include:

Configurable Deal Templates: Accelerate setup by selecting and customizing pre-defined templates created by dv01, designed to reflect common deal structures and triggers.

Flexible Collateral Selection: Build replines or upload a loan tape directly within dv01.

Waterfall Builder: Define waterfall structure, including tranches, fees, and accounts.

Configurable Payment Rules: Define priority of payments, including payment rules, triggers, and other calculations.

Dynamic Cashflow Modeling: Run multiple cashflow scenarios using custom assumptions to evaluate deal performance.

Innovation Beyond Structuring

This launch is just one of several advancements dv01 is rolling out to support structured products market participants. By leveraging its interconnected platform, dv01 is redefining workflows and delivering tools that adapt to evolving market demands.

For more information or to schedule a demo, visit www.dv01.co/offerings/dealstudio or contact sales@dv01.co.

About dv01

dv01 is a leading capital markets fintech company driving technological innovation and loan-level transparency in structured finance. As the world’s first end-to-end data management, reporting, and analytics platform for loan-level lending data, dv01 is bringing unparalleled transparency and intelligence to every loan for every stakeholder.

With over 230 million loans, 1,300 transactions, and $6 trillion in original balance across the consumer unsecured, mortgage, auto, student loan, point of sale, home efficiency and small business asset classes, dv01 is building the most comprehensive loan data library across lending markets and empowering capital markets with world-class tools to make safer data-driven decisions. Learn more at www.dv01.co.

RELATED POSTS

Press

dv01 Unveils dv01 DealStudio: Structuring Tool to Streamline Deal Modeling for Private Credit Transactions and Securitizations

10 February 2025