Research

Insights: COVID-19 Performance Report, Volume 5

28 May 2020

About the dv01 Insights Report

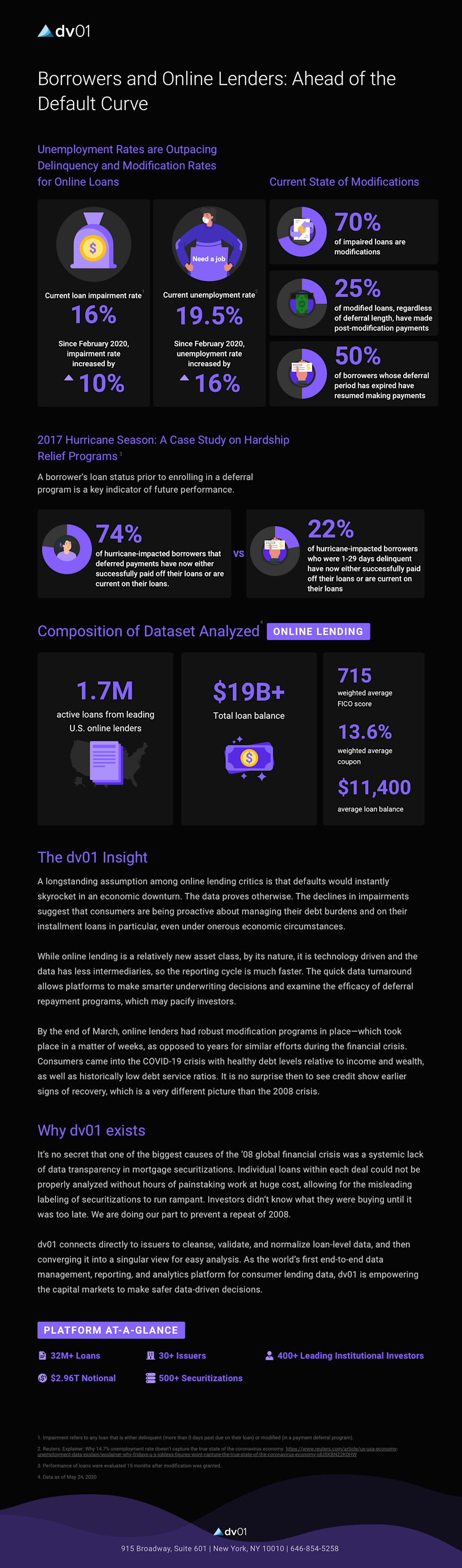

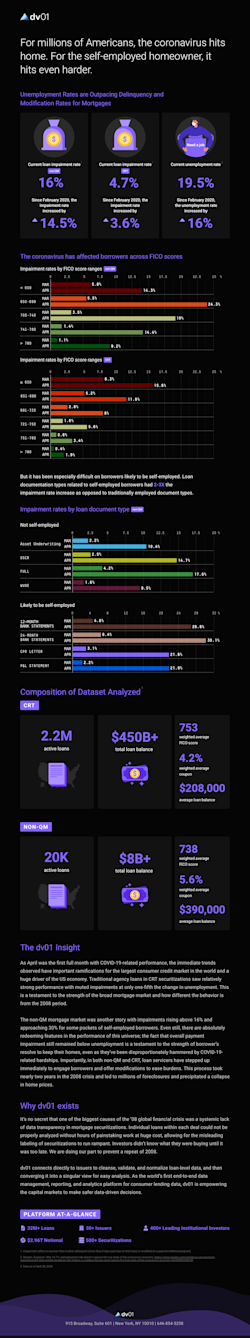

Total payment impairments have hit a near-term peak in the online lending universe and have begun to decline in earnest. Conversely, the first full month of COVID-19 mortgage performance has shown divergent impairment and prepayment trends between traditional GSE loans in CRT and non-QM, which represents more of the self-employed universe.

In the fifth installment of our COVID-19 Performance Report, we have incorporated the latest performance data for CRT and non-QM loans and shared observations on prepayments and payment impairment trends. We have also provided insights on the decline in total payment impairments within the online lending sector.

Get a glimpse of the insights we've gleaned through our infographics below the form, and download our latest report to read our complete findings.

RELATED POSTS