esg

Quantifying Net Zero Initiatives in Residential Mortgages

6 October 2022

The financial industry has created a litany of organizations, initiatives, and other efforts to formalize sustainable investment processes and disclosures. While the UN Principles for Responsible Investing remains the premier global investment-focused movement, other efforts have formed to focus specifically on climate change issues. For instance, the Net Zero Asset Management initiative (“NZAM”) and the Net Zero Banking Alliance (“NZBA”) emerged to coalesce large swaths of the financial services industry around the recommendations of the Paris Agreement.

Both NZAM and NZBA require financial institutions to transition all operational and attributable greenhouse gasses (“GHG”) emissions from lending and investment portfolios, with the NZBA requiring banks to measure and disclose the emissions profile of their lending and investment portfolios.

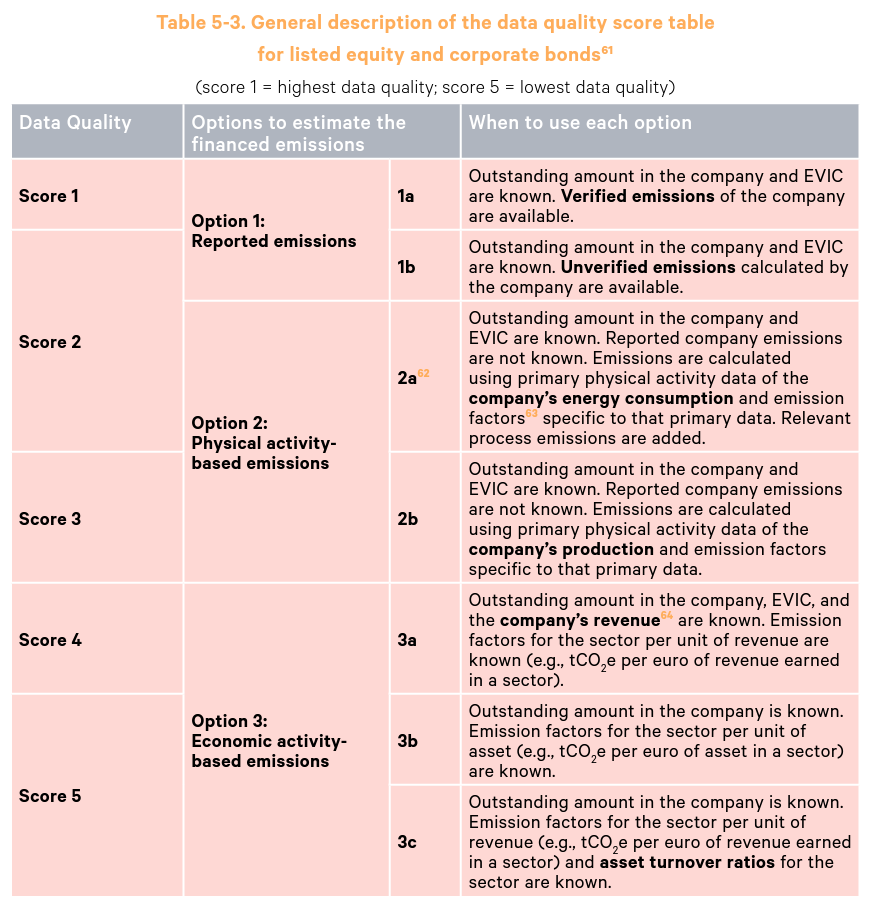

Like other areas of sustainable investing, the primary challenges with these initiatives, especially in structured credit markets, is data. Attributing GHG emissions to residential real estate portfolios—either whole loans or via securitizations—is no exception. To help facilitate accountability in finance, the Partnership for Carbon Accounting Financial (“PCAF”) provides a methodology to estimate emissions associated with residential mortgages, which includes a data quality rating on a scale of 1-5 (with 1 representing the highest data quality).

dv01 Now Calculates GHG Emission

As part of our ongoing effort to provide structured credit investors with unmatched data and transparency, we’ve onboarded datasets to our ESG Impact Intelligence offering that advance net zero commitments. dv01’s methodology calculates the emissions associated with residential real estate portfolios based on measures from utilities servicing areas and the emissions associated with the relevant power plants. We believe that our methodology is consistent with PCAF recommendations and represents a level three on data quality (see score card below), an improvement from estimates covering broader geographies and assumptions. Absent a direct reading from a property’s utility meter, we believe this methodology represents the most accurate calculation of emissions associated with residential properties. This data will help banks and asset managers account for financed emissions associated with their portfolios and enable them to reach their net zero goals over the coming decades.

Many global banks and asset managers are in the beginning stages of the race to net zero, which has moved their focus to higher emitting businesses such as coal and oil. However, these commitments cover their entire portfolios, necessitating an inclusion of real estate and mortgage portfolios. We’re proud to release our newly incorporated data set as an important tool to allow the financial services to accelerate the transition to a net zero economy.