partnership

Applying ESG Data in Structured Credit

24 February 2022

ESG investing has been one of the fastest growing areas in financial services. Investment firms have added dedicated products, developed research teams, and sharpened investment processes to include ESG analysis, while service providers have introduced a vast array of ESG data, scores, and ratings. Most of these solutions have focused on equities and corporate bonds, yet leave a hole in structured credit: current data solutions only disclose information at the originator or issuer level, failing to give investors a comprehensive understanding of their underlying assets.

dv01’s ESG Impact Intelligence tool fills the void, providing detailed loan-level social and environmental data, which allows the market to fully understand ESG factors for securitizations. factors for securitizations. The loan-level ESG data serves as the foundation of ESG strategies and mandates by offering previously unattainable insights, such as the percentage of loans located in under-served communities and natural disaster zones.

One of the driving forces behind the ESG movement is the UN Principles for Responsible Investing (“UN PRI”), which started in 2006 as a result of the collaboration between then UN Secretary General Kofi Annan and a group of large institutional investors. To solidify their ESG pedigrees, firms added their names to the ever-growing list of UN PRI signatories, pledging to develop a more sustainable financial system.

Upon signing the PRI, firms formally acknowledge that ESG factors can affect the performance of investment portfolios and commit to the following six principles:

Incorporate ESG issues into investment analysis and decision-making processes.

Be active owners and incorporate ESG issues into our ownership policies and practices.

Seek appropriate disclosure on ESG issues by the entities in which we invest.

Promote acceptance and implementation of the Principles within the investment industry.

Work together to enhance our effectiveness in implementing the Principles.

Report on activities and progress towards implementing the Principles.

Of the six principles, investors are able to achieve four by themselves (2, 4, 5, and 6). However, achieving principles 1 and 3 requires a trustworthy data provider that can supply actionable information that overcomes the limitations structured credit investors face: a lack of loan-level data.

Unlike equity investors, who have access to seemingly unlimited ESG datasets, data providers, and ratings, structured credit investors rely solely on underwriting practices and general corporate behavior, or purchase bonds that focus on a single data point but may not have entirely favorable ESG characteristics (e.g., homes with solar panels generally reside in affluent areas with borrowers who can easily access credit and low-documentation loans issued to financially secure borrowers).

The lack of loan-level ESG data results in an incomplete analysis of social and environmental factors, leaving investors short of upholding Principle 1. dv01’s pioneering new approach enriches loan tapes with loan-level ESG data, allowing for a comprehensive evaluation of each securitization or loan portfolio. Additionally, as the preeminent transparency provider in the structured credit market, dv01 can partner with issuers and investors to satisfy Principle 3. As Loan Data Agent for nearly 400 securitizations, dv01 can facilitate the distribution of appropriate ESG data to deal participants and the broader market, and our Portfolio Surveillance offering enables investors to understand ESG factors at the loan-level of their portfolios.

Not only does dv01’s ESG Impact Intelligence help fulfill investors’ commitments to the UN PRI, but our comprehensive data solution also illustrates alignment with market-accepted ESG standards, ranging from disclosure guidelines to impact investing objectives.

Frameworks Used By dv01

ICMA Social Bond Principles (“SBP”)

The International Capital Market Association (“ICMA”) developed the Social Bond Principles to promote integrity in the social bond market through transparency, disclosure, and reporting. The SBPs are intended for use by market participants and are designed to increase capital allocation to social projects without any single arbiter.

ICMA provides examples of social projects that fit within the SBP, including access to essential services (e.g., financial services), affordable housing, and socioeconomic advancement and empowerment. In addition, the group specifies examples of targeted populations such as those living below the poverty line, excluded and/or marginalized populations, undereducated, underserved, unemployed, and other vulnerable groups. dv01 can append demographic and socioeconomic data to provide the number and value of loans located in specific targeted populations.

ICMA Green Bond Principles (“GBP”)

Alongside the SBPs, ICMA also established the Green Bond Principles to enhance the role that debt markets can play in funding environmentally sustainable projects. By recommending that issuers report on the use of proceeds, the GBP facilitates the tracking of funds into environmental projects, while simultaneously aiming to improve insight into their estimated impact.

ICMA provides examples of green projects that fit within the GBP, including energy efficiency, pollution prevention and control, clean transportation, climate change adaptation, and green buildings. dv01 can provide environmental data that unearths loans located in areas susceptible to natural hazards according to FEMA-designations.

Sustainable Accounting Standards Board (“SASB”)

In the US, SASB continues to provide guidance for ESG disclosures across 77 industries, including mortgage finance and consumer finance. The recommendations include both qualitative and quantitative disclosures. dv01 can provide the number and value of loans made to individuals with a FICO less than 660 and the number and value of loans in areas designated as flood zones by FEMA, satisfying two of the major quantitative disclosure recommendations.

GIIN IRIS+ Taxonomy

Impact investing is an investment philosophy that emphasizes social returns in addition to financial returns. While some impact investors accept concessionary financial returns, many look for market rate of returns while also quantifying the impact of their portfolios. The Global Impact Investing Network (“GIIN”), a nonprofit dedicated to impact investing, developed IRIS+, a catalog of generally accepted performance metrics and established areas of potential impact.

The IRIS+ Thematic Taxonomy includes a section on Financial Services, which stresses improving access to responsible financial services for historically underserved populations, improving financial health, and improving rural economies through financial inclusion.

UN Sustainable Development Goals (“SDG”)

Adopted by all United Nations Member States in 2015, the SDGs “provide a shared blueprint for peace and prosperity for people and the planet, now and into the future. At its heart are the 17 SDGs, which are an urgent call for action by all countries - developed and developing - in a global partnership.”

While not all 17 goals present investable opportunities, particularly in structured credit, there are still numerous opportunities to align portfolios with the UN’s lofty goals. For example, SDG 1 (No Poverty) strives to eradicate poverty in all its forms through various sub-targets, including ensuring all men and women—particularly the poor and vulnerable—have access to essential services, such as financial services and micro-finance. Similarly, SDG 10 (Reduced Inequalities) “promotes the social, economic, and political inclusion of all, irrespective of age, sex, disability, race, ethnicity, origin, religion or economic or other status.”

How dv01 Data Aligns With Existing ESG Frameworks

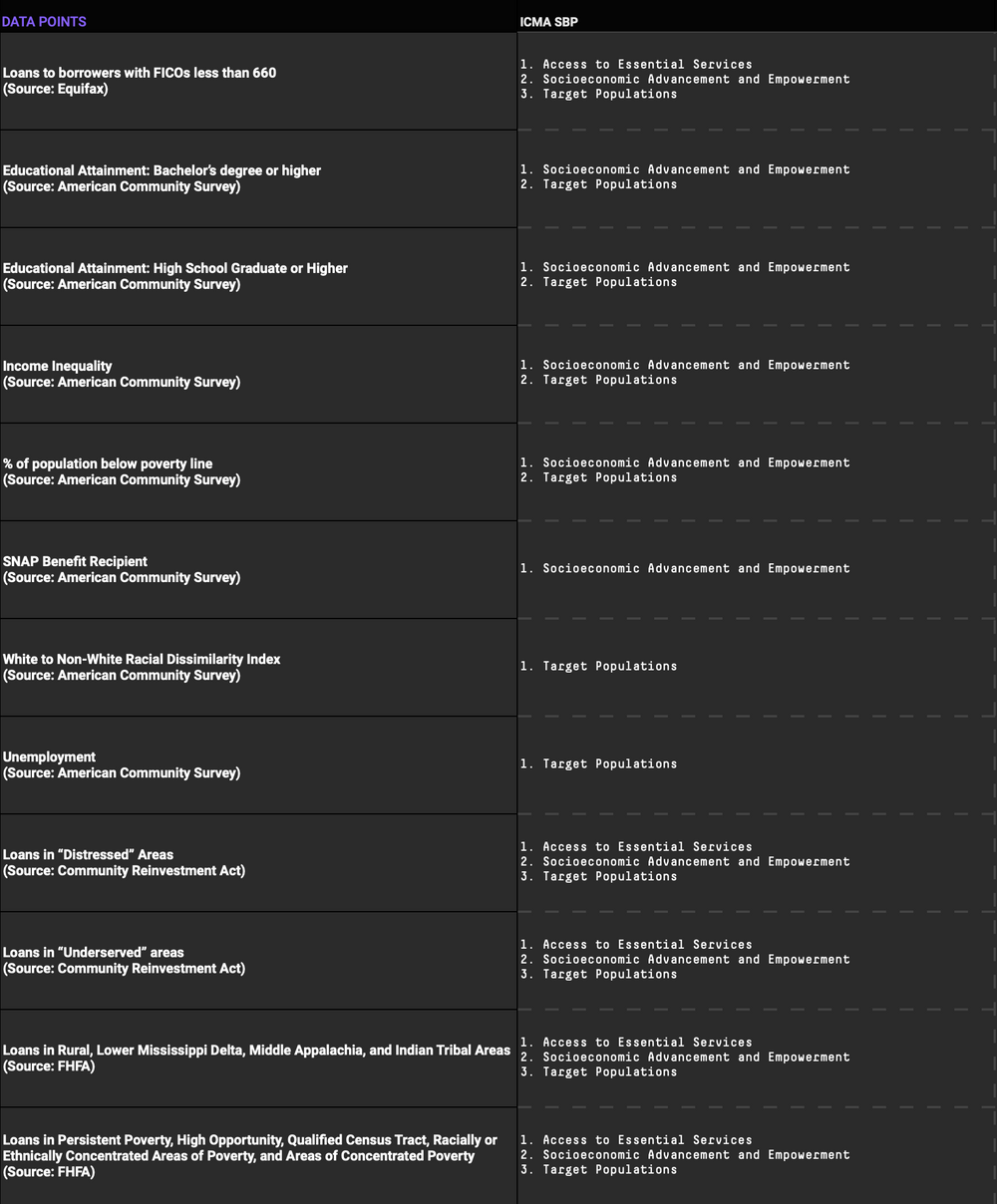

dv01’s ESG data helps investors align with the five aforementioned frameworks. Unlike other ESG analysis that focuses on originators and issuers, dv01 provides the loan-level data needed for investors and issuers to assess the environmental and social characteristics of their portfolios. Below is a subset of dv01’s enriched ESG dataset with descriptions of the data and how it aligns with the ICMA SBP, which support targeted populations and promote social projects:

Alignment of dv01 loan-level ESG data with ICMA Social Bond Principles

ESG in structured finance is evolving; investors are still building their strategies, while issuers face even scrutiny over the sustainability of their bonds. dv01’s loan-level ESG data and technology help investors comprehensively assess the ESG factors in their portfolios, and helps issuers provide confidence in their alignment with market accepted social and environmental principles. As the ESG investing market continues to evolve, dv01 will remain committed to providing the loan-level data necessary for investors to comply with ESG-related commitments and the transparency for investors and issuers to align with ESG standards. Contact us to run your portfolio through our ESG assessment toolkit.

RELATED POSTS