why-dv01

The Risk of Operational Fragility: Why Lasting Stability Starts with Durable Infrastructure

8 April 2025

About this Series

In this series, we’re exploring the hidden risks of relying on fragmented workflows, outdated infrastructure, or emerging vendors without the proven expertise—and what’s at stake if they’re left unaddressed. Whether you're an originator managing growing loan volume, an issuer preparing complex transactions, or an investor monitoring portfolio performance, these are the challenges that quietly build over time—and the risks worth solving for.

The Risk of Operational Fragility: Why Lasting Stability Starts with Durable Infrastructure

Behind every great operation is a great team. But in capital markets, many critical workflows still depend on aging infrastructure, a patchwork of single-purpose vendors, and nimble teams working overtime to keep everything running.

And that works—until it doesn’t.

Over time, even the most reliable processes can become vulnerable. Teams shift. Priorities change. Knowledge gaps appear. And without durable systems in place, those small cracks can turn into bigger operational challenges.

At the same time, newer vendors can introduce similar risks. Emerging startups often build products around narrow use cases, with smaller teams and limited experience navigating the full capital markets ecosystem. When those products become critical to your operations, you may find yourself dependent on infrastructure that’s still evolving—without the depth, business stability, or long-term support you need.

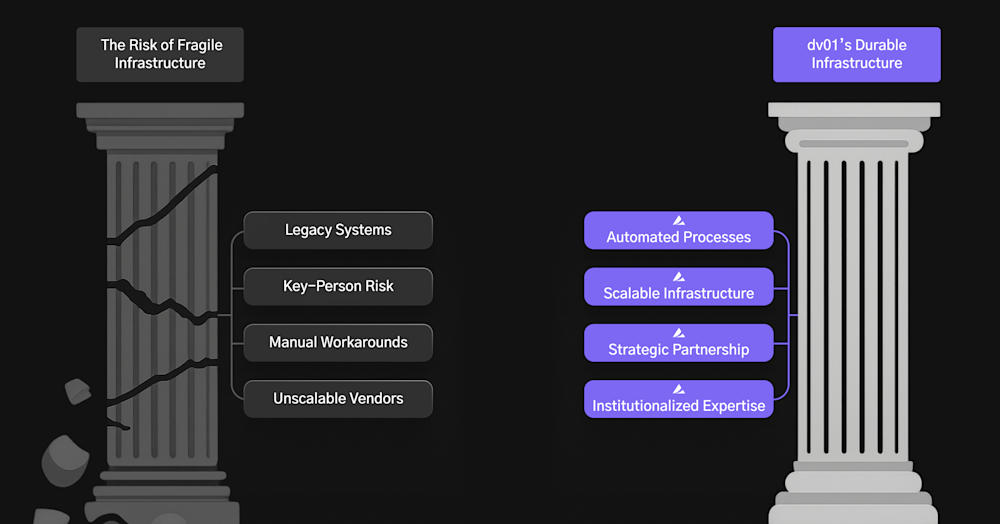

What Fragile Foundations Look Like in Practice:

Relying on aging, inflexible technology that struggles to meet modern compliance and security requirements.

A single analyst managing complex, multi-step reporting with limited documentation.

Custom spreadsheets and macros that no one else on the team can easily maintain.

Vendor solutions that work for now but may not scale or last as your needs evolve.

Scrambling to backfill knowledge when key employees transition out.

Why This Matters

Operational risk doesn’t just come from external shocks—it builds quietly within organizations. When success relies on fragile foundations—whether that’s aging systems, unproven vendors, or key-person knowledge—the entire operation becomes harder to maintain and scale. Growth slows, reliability suffers, and the cracks only widen over time.

The dv01 Difference

dv01 helps create sustainable infrastructure that supports your team—not replaces it.

We codify and automate the most complex, high-stakes processes.

We provide durable infrastructure backed by Fitch, so you're not reliant on short-term vendors still proving themselves.

We scale with you, ensuring that as your business grows, your operational foundation stays strong.

With dv01, you're not just patching over cracks—you’re setting your team up for long-term success with systems that are built to last.

Ready to Strengthen Your Foundation?

dv01 helps originators, issuers, and investors build durable infrastructure that scales with their business. Contact us to learn how we can support your workflows with proven technology and long-term stability.