The Data Infrastructure Powering Transparency and Efficiency for RMBS and ABS

dv01 In the Tranches of Structured Finance podcast episodes now available

Listen Now

dv01's comprehensive capabilities are tailored to a wide range of structures

600+ leading issuers and investors rely on dv01 to drive workflow efficiency and deliver premier loan-level data management

An integrated suite of products built specifically for market participants

Reduce costs and operate more efficiently on a fully integrated platform. Handle all your asset-based finance needs from a single place—from managing loan-level data to seamless performance reporting.

Putting the structure in structured finance

As an end-to-end solution for issuers and investors, dv01 standardizes loan-level data and offers fully integrated analytics tools to dive deep into the underlying collateral.

Asset Classes

Consumer Unsecured

Mortgage

Solar

Student Loan

Point of Sale

Auto

Small Business

Credit Card

Dataset Types

Industry Benchmarks

Securitizations

Whole Loan Portfolios

Tools

Cashflow

Strat Tables

Performance Data

Time-Series Analysis

Tape Cracker

Leverage Optimizer

ESG Data Enrichment

Clients

Investment Banks

Banks

Issuers

Originators

Hedge Funds

Asset Managers

Insurance Companies

Credit Unions

Ensure accuracy, consistency, and confidence for each loan

With dv01, your data undergoes rigorous validation and standardization processes, ensuring that every dataset is accurate, consistent, and actionable. From onboarding to reporting, dv01 safeguards the integrity of your loan-level data, so you can make decisions with confidence and precision.

Streamline your workflows with interconnected, purpose-built solutions.

dv01’s platform embeds world-class tools, enabling seamless transitions between data ingestion, analysis, and reporting. Whether managing loan pools, structuring deals, or monitoring performance, our integrated solutions eliminate silos and deliver efficiency across every stage of your workflow.

Flexible infrastructure designed to meet your unique needs

dv01’s robust infrastructure supports seamless data management, reporting, and analytics across a wide range of asset classes.

Comprehensive solutions tailored to your workflow and specialization

dv01’s robust infrastructure enables seamless data management, reporting, and analytics to support your operations.

Market Data

Industry-leading insights with benchmark datasets, issuer performance data, housing affordability, ESG metrics, and more

Deal Reporting

Data management, analytics, and performance reporting for securitizations and private credit transactions

Portfolio Management

Data management and analytics to monitor loan performance for securitizations and private credit deals

Credit Facility Management

Automated borrowing base reporting and optimized loan allocation designed for warehouse facilities

Loan Pool Evaluation

Data wrangling tool powered by machine learning for assessing and standardizing loans for purchase

Data Management

Comprehensive loan data ingestion, validation, and standardization, fully managed by dv01

Deal Structuring

Structuring tool for modeling, tranche structuring, and waterfall analysis.

World-class tools to power smarter decisions at every stage

dv01’s platform integrates analytics directly into your workflow, offering unparalleled insights and decision-making capabilities through powerful, embedded tools.

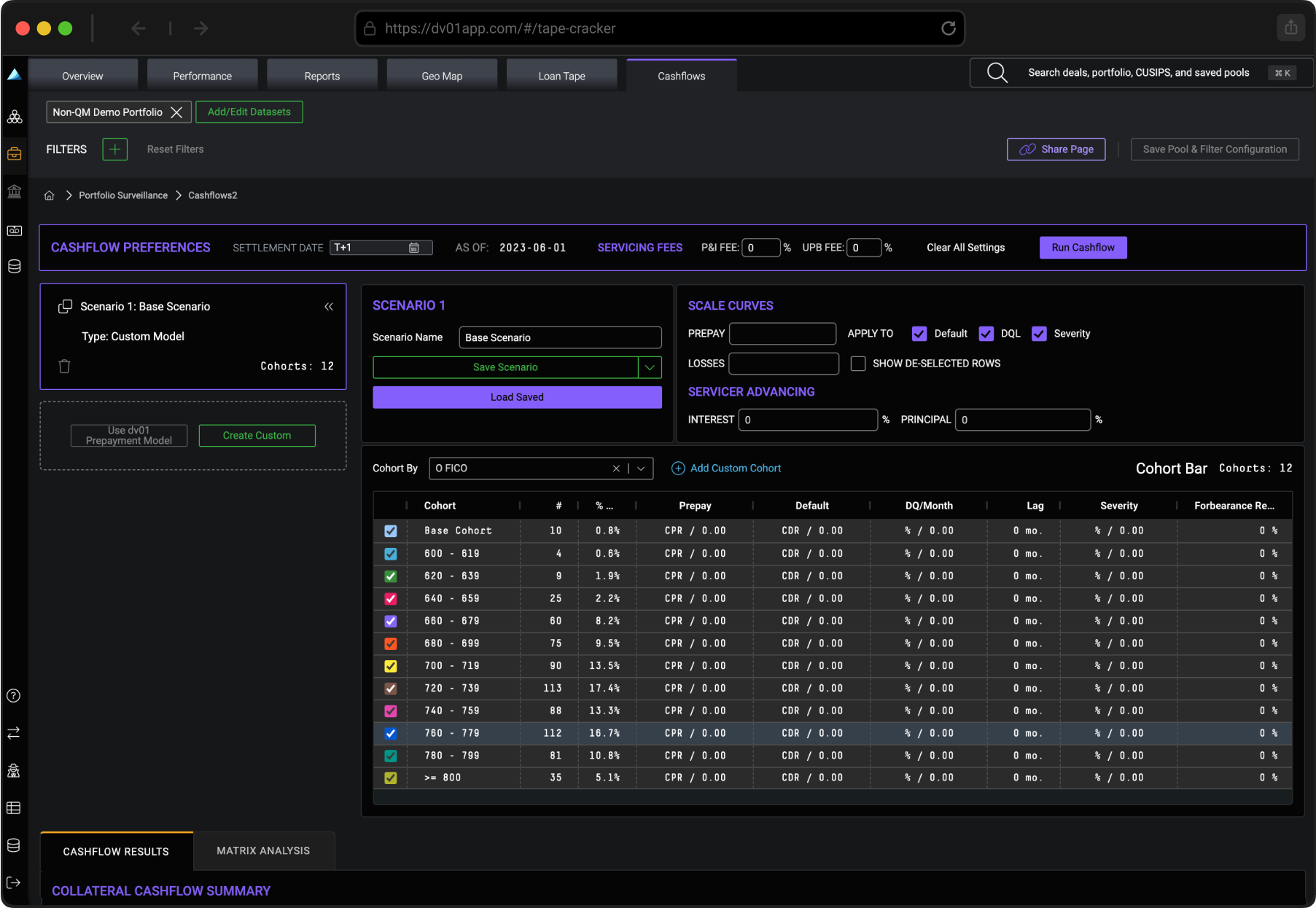

Cashflow Engine

Loan-level and deal-level cashflow analysis with custom scenarios, prepayment assumptions, and stress testing.

Visualization and Cohorting

Customizable stratification tables, pivot tables, and cohort groupings for granular analysis of asset performance.

Performance Charting

Detailed analysis of CPR, CDR, and CNL trends across portfolios by loan age, month on book, and other key metrics.

Saved Views and Scenarios

Curated dashboards and saved scenarios to streamline recurring analysis and reporting.

Built to scale with the demands of ABS, RMBS, and asset-backed private credit

1,300

Transactions

370 Million

Loans

$8 Trillion

Notional Balance